If you have a GST registered business in India, you have to provide GST compliant invoices to your customers to sell services or goods. It eliminates any doubt about when the payment is due and eliminates the possibility of denying information about the payment. Since an invoice is a legal document that is part of a sale, including the due date in the invoice will keep the consumer informed.

These dates signify that the payment is due and will result in several penalties and interest if the payment is not received by the due date. In a general business context, the due date refers to the latest date by when a payment can be made on an invoice before it becomes overdue or late. When it comes to invoicing, including a due date will help facilitate prompt payment. Read our article on the time limit to issue invoices and bill of supply to know more about it. There are separate time limits to issue the invoices for the supply of goods and services. However, the time of raising tax invoices is generally determined by the GST law. Again, a 30-day credit period is applied from the date of the invoice. When it comes to the rendering of services, invoices must be raised monthly by the end of the month. In general trade parlance, for the supply of goods, invoices are raised as soon as the goods are delivered with a usual credit period ranging up to 30 days from the invoice date. To keep track of business income for tax purposes.Invoice can be used as historical data to predict future revenue.To track the inventory of the business.To keep an account of the sales or supplies.Invoice forms the basis for requesting clients or customers to make payments on time.Businesses use invoices for several reasons, such as follows:

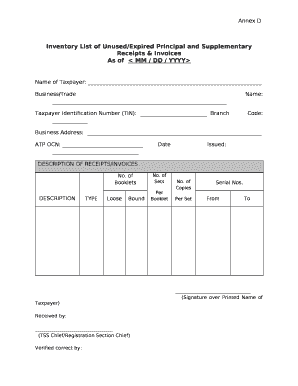

#Business invoice and inventory professional

It is issued by every business and professional to keep track of sales made and services provided. Invoices are primarily used for keeping track of all the sales transactions by any business organisation with its customers. Who uses an invoice, and what is the purpose?įor accounting, invoices are used as a source document. Invoice can be defined as “a list of goods sent or services provided, with a statement of the sum due for these a bill.”, as per the Oxford English Dictionary. Invoices are the business records that allow companies to get paid for their services, so invoicing is critical for small businesses. An invoice details how much your client owes you when payment is due and what services you rendered. Invoices are the foundation of a small business’ accounting system. An invoice is a document that describes the goods and services that a company offers to a customer and specifies the customer’s responsibility to pay for those products and services.

0 kommentar(er)

0 kommentar(er)